In the third part of this series, we will be looking at how to Download & Compare of GSTN data using Saral GST. In our previous steps, we have entered or imported the data and created the JSON file. Now we will be downloading and comparing the GSTN data.

Invoices which have been uploaded at various times can be downloaded and compared with the existing data in software. This is done to look for any mismatch in the details entered and details uploaded earlier.

The download can be done in two ways:

- Offline Download

- Online Download

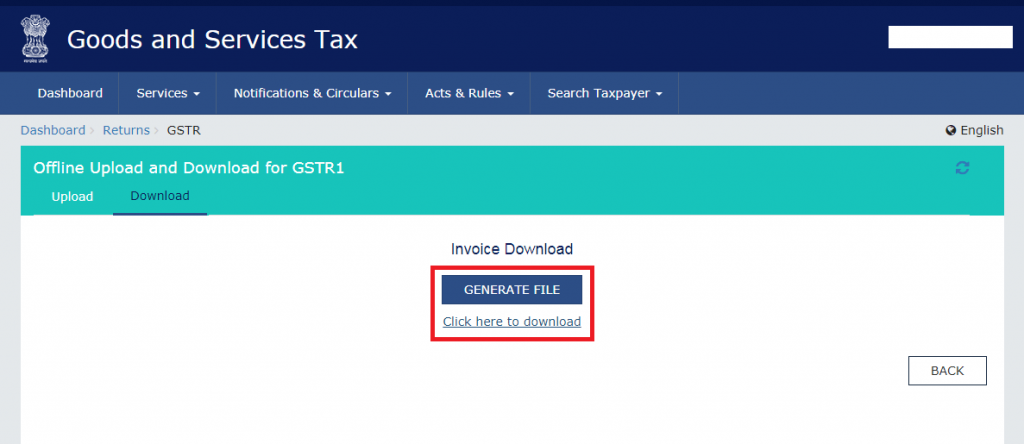

Offline Download: If the filing type is selected as “File through GST portal”, then the data comparison will be done through the offline method.

For the process, goto GST portal -> Login -> Return dashboard. Select the FY and period of filing. Select on GSRT1 -> Prepare Offline -> Download. Click on Generate file. A JSON file will be generated & downloaded.

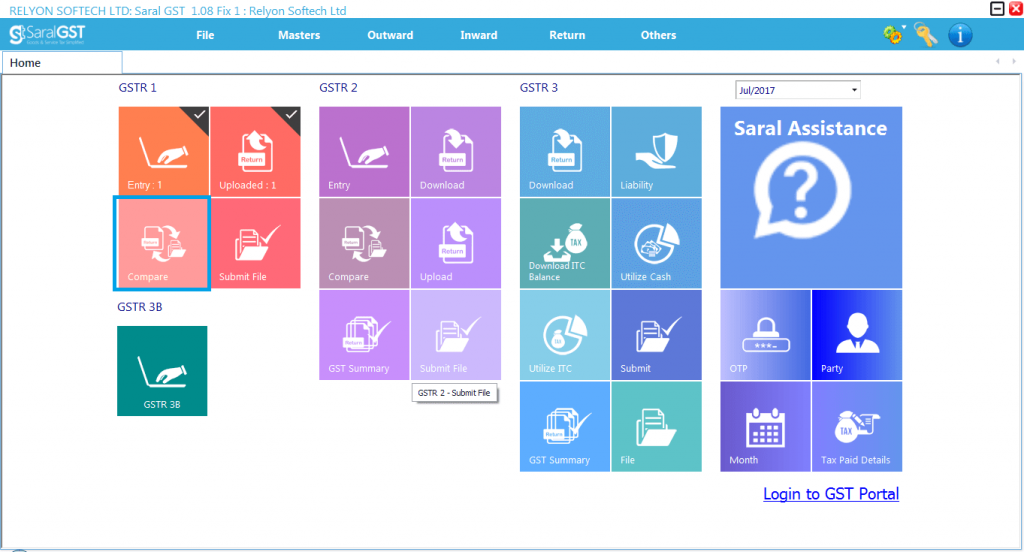

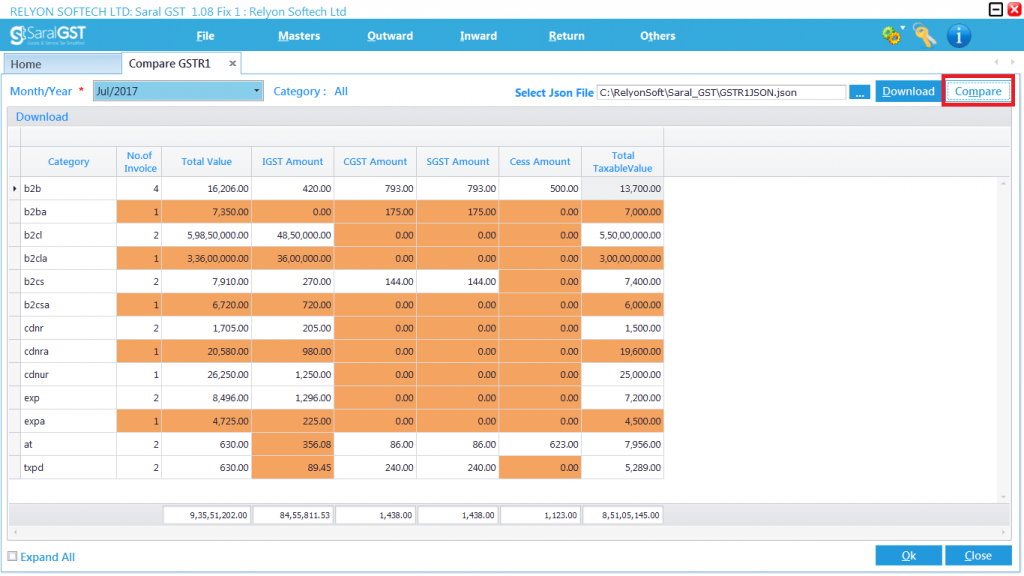

Now, goto Saral GST and click on Compare.

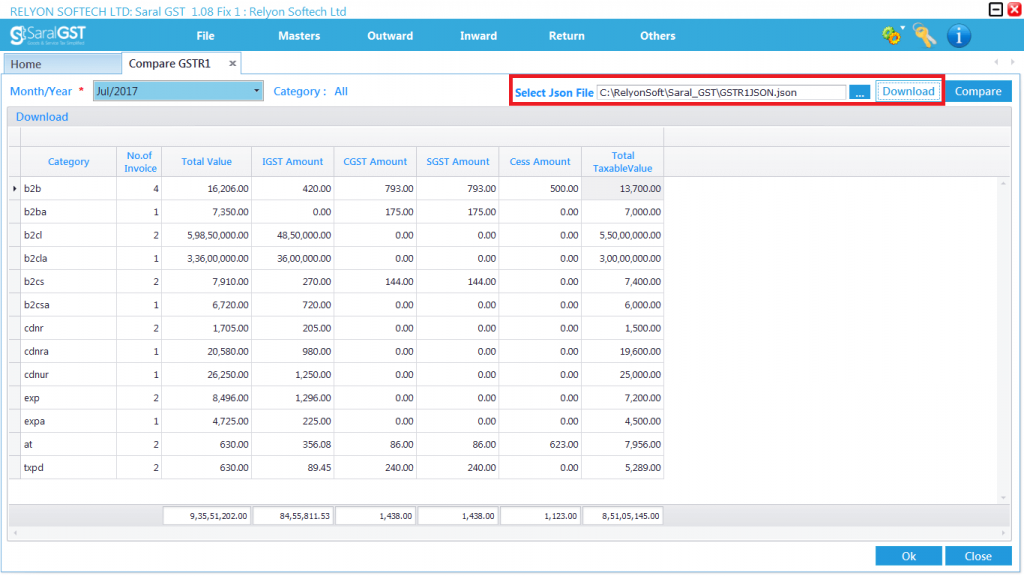

Select the downloaded JSON file and click on Download.

Once the data is loaded, click on Compare. If any data is found to be mismatched those details will be highlighted in orange color.

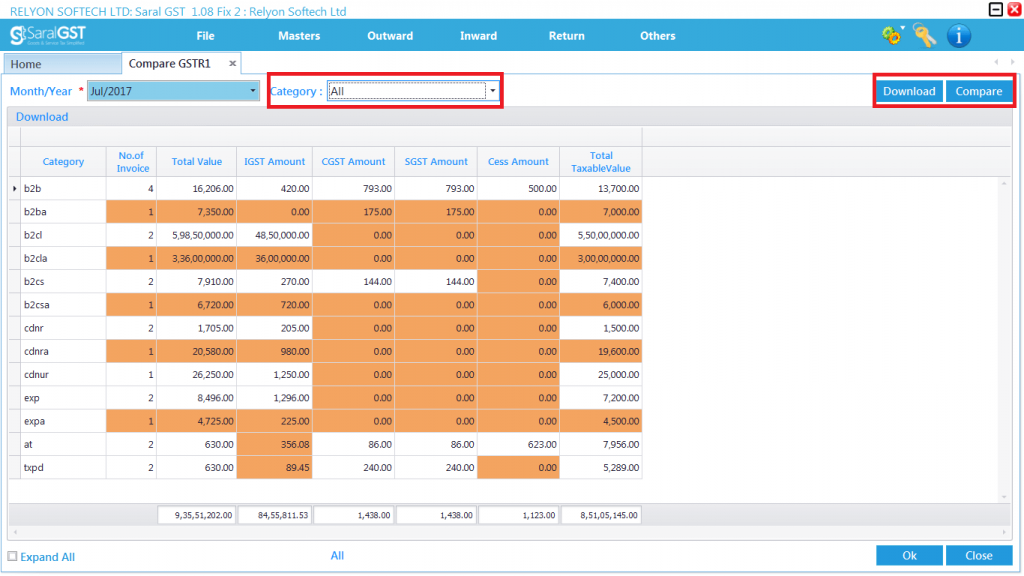

Online Download & Compare: If the filing type is selected as “File through GSP”, then the data comparison will be done through online method.

Goto Saral GST and click on Compare. Next, click on Download to auto download the JSON file from GST portal and load to the software. Once the data is loaded, click on Compare. If any data is found to be mismatched those details will be highlighted in orange color.

Note: Details can be viewed Category wise by selecting the required category.

So this is it for downloading and comparing GSTN data. We hope that you found it useful. If you have any comments, drop them below.

You can also learn about GSTR-1 in general