- E-way Bill

- E-way Bill - General Portal

- E-way Bill - Registration

- E-way Bill - Enrolment

- E-way Bill - Login

- E-way Bill - Updating Transportation/vehicle/Part-B details

- E-way Bill - Cancelling EWB

- E-way Bill - Rejecting EWB

- E-way Bill - Consolidated EWB

- E-way Bill - Other modes

- E-way Bill - Other Options

- E-way Bill - Miscellaneous

- Overview of GST

- Enrollment to GST

- Levy of and Exemption from Tax

- Registration

- Meaning and Scope of Supply

- Time of Supply

- Valuation in GST

- GST Payment of Tax

- Electronic Commerce

- Job Work

- Input Tax Credit

- Input Service Distributor

- Return Process and Matching of ITC

- Assessment and Audit

- Refunds

- Demands and Recovery

- Appeals, Review, Revision

- Advance Ruling

- Inspection, Search, Seizure and Arrest

- Offences,Penalties,Prosecution & Compounding

- Overview of the IGST Act

- Place of Supply of Goods & Service

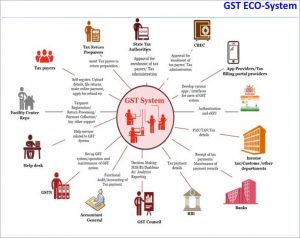

- GSTN & Frontend Business Process on GST Portal

- Transitional Provisions

- Composition Levy

What is an e-way bill?

e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder. It is generated from the GST Common Portal for eWay bill system by the registered persons or transporters who cause movement of goods of consignment before commencement of such movement.

Why is the e-way bill required?

Section 68 of the Act mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed. Rule 138 of CGST Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods in certain prescribed cases. Hence e-way bill generated from the common portal is required.

Who all can generate the e-way bill?

The consignor or consignee, as a registered person or a transporter of the goods can generate the e-way bill. The unregistered transporter can enroll on the common portal and generate the e-way bill for movement of goods for his clients. Any person can also enroll and generate the e-way bill for movement of goods for his/her own use.

What are pre-requisites to generate the e-way bill?

The pre-requisite for generation of eway bill is that the person who generates eway bill should be a registered person on GST portal and he should register in the eway bill portal. If the transporter is not registered person under GST it is mandatory for him to get enrolled on e-waybill portal (https://ewaybillgst.gov.in) before generation of the e-way bill. The documents such as tax invoice or bill of sale or delivery challan and Transporter’s Id, who is transporting the goods with transporter document number or the vehicle number in which the goods are transported, must be available with the person who is generating the e-way bill.

If there is a mistake or wrong entry in the e-way bill, what has to be done?

If there is a mistake, incorrect or wrong entry in the e-way bill, then it cannot be edited or corrected. Only option is cancellation of eway bill and generate a new one with correct details.

Whether e-way bill is required for all the goods that are being transported?

The e-way bill is required to transport all the goods except exempted under the notifications or rules. Movement of handicraft goods or goods for job-work purposes under specified circumstances also requires e-way bill even if the value of consignment is less than fifty thousand rupees. Kindly refer to the e-way bill rules for other exemptions.

Is there any validity period for e-way bill?

Yes. Validity of the e-way bill depends upon the distance the goods have to be transported. In case of regular vehicle or transportation modes, for every 100 KMs or part of its movement, one day validity has been provided. And in case of Over Dimensional Cargo vehicles, for every 20 KMs or part of its movement, one day validity is provided. And this validity expires on the midnight of last day.

While calculating time validity for e-way bill, how is a day determined?

This can be explained by following examples –

(i) Suppose an e-way bill is generated at 00:04 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

(ii) Suppose an e-way bill is generated at 23:58 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

Which types of transactions that need the e-way bill?

For transportation of goods in relation to all types of transactions such as outward supply whether within the State or interstate, inward supply whether from within the State or from interstate including from unregistered persons or for reasons other than supply also e-way bill is mandatory. Please refer relevant notifications/rules for details. However, from 1st April 2018, e-way is required only for interstate movement. The e-way requirement for intra state movement will be notified later.

What is the Part-A Slip?

Part-A Slip is a temporary number generated after entering all the details in PART-A. This can be shared or used by transporter or yourself later to enter the PART-B and generate the E-way Bill. This will be useful when you have prepared invoice relating to your business transaction, but don’t have the transportation details. Thus you can enter invoice details in Part A of an eway bill and keep it ready for entering details of the mode of transportation in Part B of an eway bill.

When I enter the details in e-way bill form, the system is not generating e-way bill, but showing Part-A Slip?

If you don’t enter the vehicle number for transportation by road or transport document number for other cases, the system will show you the PART-A slip. It indicates that you have not completed the e-way bill generation process. Only when you enter the Part-B details, e-way bill will be generated.

How to generate e-way bill from Part-A Slip?

Part-A Slip is entry made by user to temporarily store the document details on the e-way bill system. Once the goods are ready for movement from the business premises and transportation details are known, the user can enter the Part-B details and generate the e-way bill for movement of goods. Hence, Part-B details convert the Part-A slip into e-way bill.

What are the documents that need to be carried along with the goods being transported?

The person in charge of a conveyance shall carry the invoice or bill of supply or delivery challan, bill of entry as the case may be and a copy of the e-way bill number generated from the common portal. Please refer relevant rules for details.

How to generate the e-way bill from different registered place of business?

The registered person can generate the e-way bill from his account from any registered place of business. However, he/she needs to enter the address accordingly in the e-way bill. He/she can also create sub-users for a particular business place and assigned the role for generating the e-way bill to that sub user for that particular business place.

How does taxpayer enter Part-A details and generate e-way bill, when he is transporting goods himself?

Sometimes, the taxpayer wants to move the goods himself. E-way bill Portal expects the user to enter transporter ID or vehicle number. So if he wants to move the goods himself, he can enter his GSTIN in the transporter Id field and generate Part-A Slip. This indicates to the system that he is a transporter and he can enter details in Part-B later when transportation details are available.

What has to be entered in GSTIN column, if consignor or consignee is not having GSTIN?

If the consignor or consignee is an unregistered taxpayer and not having GSTIN, then the user has to enter ‘URP’ [Unregistered Person] in corresponding GSTIN column.

When does the validity of the e-way bill start?

The validity of the e-way bill starts when first entry is made in Part-B i.e. vehicle entry is made first time in case of road transportation or first transport document number entry in case of rail/air/ship transportation, whichever is the first entry. It may be noted that validity is not re-calculated for subsequent entries in Part-B.

How is the validity of the e-way bill calculated?

The validity period of the EWB is calculated based on the ‘approx. distance’ entered while generating the EWB. For every 100 Kms one day is a validity period for EWB as per rule and for part of 100 KM, one more day is added. For e.g. If approx. distance is 310 Kms then validity period is 3+1 days. For movement of Over Dimensional Cargo (ODC), the validity is one day for every 20 KM (instead of 100 KM) and for every 20KM or part thereof one more day is added. Please refer relevant rules for details.

How the distance has to be calculated, if the consignments are imported from or exported to other country?

The approximate distance for movement of consignment from the source to destination has to be considered based on the distance within the country. That is, in case of export, the consignor place to the place from where the consignment is leaving the country, after customs clearance and in case of import, the place where the consignment is reached the country to the destination place and cleared by Customs.

Whether e-way bill is required, if the goods are being purchased and moved by the consumer to his destination himself?

Yes. As per the e-way bill rules, e-way bill is required to be carried along with the goods at the time of transportation, if the value is more than Rs. 50,000/-. Under this circumstance, the consumer can get the e-way bill generated from the taxpayer or supplier, based on the bill or invoice issued by him. The consumer can also enroll as a citizen and generate the e-way bill himself.

Can the e-way bill be modified or edited?

The e-way bill once generated cannot be edited or modified. Only Part-B can be updated. However, if the e-way bill is generated with wrong information, it can be cancelled and generated afresh. The cancellation is required to be done within twenty-four hours from the time of generation.

Before submission, the system is not allowing to edit the details. What is the reason?

The system allows editing the details of e-way bill entries before submission. However, if the products/commodities details are entered, it will not allow editing some fields as the tax rates will change. To enable this, please delete the products and edit the required fields and enter the products again.

The system shows the ‘Invalid Format’ when we are trying to enter the vehicle number. What is the reason?

The system expects you to enter the vehicle number details in a proper format. Please see the format details in the help with the vehicle entry field.

What are the formats of vehicle number entry?

To enable proper entry of the vehicle number, the following formats have been provided for the vehicle numbers

| Format | RC Numbers | Example Entry |

|---|---|---|

| ABC1234 | DEF 234 | DEF0234 |

| AB123456 | UP 1 345 | UP010345 |

| AB12A1234 | AP 5 P 23 | AP05P0023 |

| AB12AB1234 | TN 10 DE 45 | TN 10 DE 45 |

| AB12ABC1234 | KE 3 PEW 1265 | KE03PEW1265 |

| DFXXXXXXXXXXXXX | For Defence Vehicle, start with DF | DF02K123 |

| TRXXXXXXXXXXXXX | For Temp RC Vehicle, start with TR | TRKA01000002 |

| BPXXXXXXXXXXXXX | For Bhutan Vehicle, start with BP | TRKA01000002 |

| NPXXXXXXXXXXXXX | For Nepal Vehicle, start with BP |

How to enter the vehicle number DL1AB123 as there is no format available for this in e-way bill system?

If the RC book has vehicle number like DL1A123, then you enter as DL01A0123. The vehicle entered in the e-way bill system is only for information and GST officer will accept this variation.

How can anyone verify the authenticity or the correctness of e-way bill?

Any person can verify the authenticity or the correctness of e-way bill by entering EWB No, EWB Date, Generator ID and Doc No in the search option of EWB Portal.

How to generate e-way bill for multiple invoices belonging to same consignor and consignee?

If multiple invoices are issued by the supplier to the recipient, that is, for movement of goods of more than one invoice of same consignor and consignee, multiple EWBs have to be generated. That is, for each invoice, one EWB has to be generated, irrespective of the fact whether same or different consignors or consignees are involved. Multiple invoices cannot be clubbed to generate one EWB. However, after generating all these EWBs, one Consolidated EWB can be prepared for transportation purpose, if goods are going in one vehicle.

What has to be done by the transporter if consignee refuses to take goods or rejects the goods for any reason?

There is a chance that consignee or recipient may reject to take the delivery of consignment due to various reasons. Under such circumstances, the transporter can get one more e-way bill generated with the help of supplier or recipient by indicating supply as ‘Sales Return’ with relevant documents, return the goods to the supplier as per his agreement with him.

What has to be done, if the validity of the e-way bill expires?

If the validity of e-way bill expires, the goods are not supposed to be moved. However, under the circumstance of ‘exceptional nature and trans-shipment’, the transporter may extend the validity period after updating reason for the extension and the details in PART-B of FORM GST EWB-01.

Can I extend the validity of the e-way bill?

Yes, one can extend the validity of the e-way bill, if the consignment is not being reached the destination within the validity period due to exceptional circumstance like the natural calamity, law and order issues, trans-shipment delay, accident of conveyance, etc. The transporter needs to explain this reason in details while extending the validity period.

How to extend the validity period of e-way bill?

There is an option under the e-way bill to extend the validity period. This option is available for extension of the e-way bill before 4 hours and after 4 hours of expiry of the validity. Here, the transporter will enter the e-way bill number and enter the reason for the requesting the extension, from the place (current place), approximate distance to travel and Part-B details. It may be noted that he cannot change the details of Part-A. He will get the extended validity based on the remaining distance to travel.

Who can extend the validity of the e-way bill?

The transporter, who is carrying the consignment as per the e-way bill system at the time of expiry of the validity period, can extend the validity period.

How to handle “Bill to” - “Ship to” invoice in e-way bill system?

Sometimes, the tax payer raises the bill to somebody and sends the consignment to somebody else as per the business requirements. There is a provision in the e-way bill system to handle this situation, called as ‘Bill to’ and ‘Ship to’.

In the e-way bill form, there are two portions under ‘TO’ section. On the left-hand side – ‘Billing To’ GSTIN and trade name is entered and on the right-hand side – ‘Ship to’ address of the destination of the movement is entered. The other details are entered as per the invoice.

In case of ship to state is different from Bill to State, the tax components are entered as per the billing state party. That is if the Bill to location is inter-state for the supplier, IGST is entered and if the Bill to Party location is intra-state for the supplier, the SGST and CGST are entered irrespective of movement of goods whether movement happened within the state or outside the state.

How to handle “Bill from” - “Dispatch from” invoice in e-way bill system?

Sometimes, the supplier prepares the bill from his business premises to the consignee but moves the consignment from some others’ premises to the consignee as per the business requirements. This is known as ‘Billing From’ and ‘Dispatching From’. E-way bill system has provision for this. In the e-way bill form, there are two portions under ‘FROM’ section. In the left hand side – ‘Bill From’ supplier’s GSTIN and trade name are entered and in the right hand side – ‘Dispatch From’, address of the dispatching place is entered. The other details are entered as per the invoice. In case Bill From location State is different from the State of Dispatch the Tax components are entered as per the State (Bill From). That is if the billing party is inter-state for the supplier, IGST is entered and if the billing party is intra-state for the supplier, the SGST and CGST are entered irrespective of movement of goods whether movement happened within the state or outside the state.

How the transporter is identified or assigned the e-way bill by the taxpayer for transportation?

While generating e-way bill the taxpayer has a provision to enter the transporter id in the transportation details section. If he enters 15 digits transporter id provided by his transporter, the e-way bill will be assigned to that transporter. Subsequently, the transporter can log in and update further transportation details in Part B of the eway bill.

How to generate e-way bill, if the goods of one invoice is being moved in multiple vehicles simultaneously?

Where the goods are being transported in a semi-knocked down or completely knocked down condition, the EWB shall be generated for each of such vehicles based on the delivery challans issued for that portion of the consignment as per CGST Rule 55 which provides as under:

(a) Supplier shall issue the complete invoice before dispatch of the first consignment;

(b) Supplier shall issue a delivery challan for each of the subsequent consignments, giving reference to the invoice;

(c) each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

(d) Original copy of the invoice shall be sent along with the last consignment

Please note that multiple EWBs are required to be generated in this situation. That is, the EWB has to be generated for each consignment based on the delivery challan details along with the corresponding vehicle number

What is the common portal for generation of e-way bill?

The common portal for generation of an e-way bill is ewaybillgst.gov.in

I am not getting OTP on my mobile, what should I do?

Please check if you have activated ‘Do Not Disturb (DND)’ facility on your mobile or your service provider network may be busy. You can also use OTP, which is sent on your email-id.

E-way bill system is slow - how should I proceed?

Please check your internet connectivity.

E-way bill pages or menu list are not being shown properly, what should I do?

Please check whether your system has proper version of the browser as suggested by the e-way bill portal and also check the security settings of the browser and display property of the system. The site is best viewed on Internet Explorer 11 or above, Firefox 43.5 or above and Chrome 45 or above.

I have already registered in GST Portal. Whether I need to register again on the eWay Portal?

Yes. All the registered persons under GST need to register on the portal of e-way bill namely: ewaybillgst.gov.in using his GSTIN. Once GSTIN is entered, the system sends an OTP to his registered mobile number, registered with GST Portal and after authenticating the same, the system enables him to generate his/her username and password for the e-way bill system. After generation of username and password of his/her choice, he/she may proceed to make entries to generate e-way bill.

Whenever I am trying to register, the system is saying you have already registered, how should I proceed?

This is indicating that you (your GSTIN) have already registered on the e-way bill portal and have created your username and password on the e-way bill system. Please use these credentials to log into the e-way bill system. If you have forgotten username or password, then please use the ‘Forgot Username’ or ‘Forgot Password’ facility provided on the portal to recollect your username or create new password accordingly.

Whenever, I’m trying to register with my GSTIN, the system is saying ‘Invalid GSTIN’ or the details for this GSTIN are not available in GST Common Portal. How should I resolve this issue?

This is indicating that the GSTIN entered by you is wrong or your GSTIN details are not available on the GST Common Portal. Please check the GSTIN entered or go to the GST portal (www.gst.gov.in) and check the details of your GSTIN under ‘Search Taxpayer’ tab.

Whenever I am trying to register, the system is showing wrong address or mobile number. How should I resolve this issue?

This is indicating that you might have updated your business registration details in the GST Common Portal recently. Please click the ‘Update from Common Portal’ button on the eway bill portal, to pull the latest data from the GST Common Portal. If even after this action, wrong data is displaying, kindly update the details in GST common portal through the amendment process.

Why the transporter needs to enroll on the e-way bill system?

There may be some transporters, who are not registered under the Goods and Services Tax Act, but such transporters cause the movement of goods for their clients. They need to enroll on the e-way bill portal to get 15 digit Unique Transporter Id.

What is TRANSIN or Transporter ID?

TRANSIN or Transporter id is a 15 digit unique number generated by EWB system for an unregistered transporter, once he enrolls on the system which is similar to GSTIN format and is based on state code, PAN and Check sum digit. This TRANSIN or Transporter id can be shared by transporter with his clients, who may enter this number while generating e-waybills for assigning goods to him for transportation.

How does the unregistered transporter get his unique id or transporter id?

The transporter is required to provide the essential information for enrolment on the EWB portal. The transporter id is created by the EWB system after furnishing the requisite information. The details of information to be furnished is available in the user manual.

I am unable to enroll as transporter as the system is saying ‘PAN details are not validated’?

This is indicating that PAN name and Number, entered by you, are not getting validated by the CBDT/ Income Tax system. Please enter exact name and number as in income tax database.

I am unable to enroll as transporter as the system is saying ‘Aadhaar details are not validated’?

This is indicating that Aadhaar Number, name in Aadhaar and mobile number, entered by you, are not getting validated by the Aadhaar system. Please enter correct details. However, the Aadhaar number is not must for enrolment process and the person can enroll giving his PAN Number also.

Whenever, I am trying to enroll as transporter, the system is saying you are already registered under GST system and go and register using that GSTIN.

This is indicating that you are a registered taxpayer with valid GSTIN since a validation is done on the PAN you have entered. You need not enroll again as transporter but use your GSTIN to register on eway bill portal.

Whenever I am trying to enroll as a transporter, the system is saying you have already enrolled.

This is indicating that you have already enrolled on the e-way bill portal by providing your PAN, business, and other details and created your username and password. Please use them to log into the e-way bill system. If you have forgotten the username or password, then please use the ‘Forgot Username’ or ‘Forgot Password’ facility provided on the portal to recollect your username or create new password accordingly.

Whenever, I am trying to login the system says ‘Invalid Login…Please check your username and password’. How should I resolve this issue?

This is indicating that you are trying to login to the e-way bill system with incorrect username and password. Please check the username and password being used to login to the system. If you have forgotten the username or password, then please use the ‘Forgot Username’ or ‘Forgot Password’ facility provided on the portal to recollect your username or create new password accordingly.

Whenever, I am trying to login the system says ‘Your account has been frozen’. How should I resolve this issue?

This is indicating that your account has been frozen because you might have cancelled your registration or your GSTIN has been de-activated in the GST Common Portal. Please visit the GST Common Portal (gst.gov.in) to find the status of your GSTIN under ‘Search Taxpayer’ tab. In case you are able to log in on GST portal but not log on e-Way Bill portal, please lodge your grievance at selfservice.gstsystem.in.

Whenever, I am trying to login the system says ‘your account has been blocked…Pl try after 5 minutes. How should I resolve this issue?

This is indicating that you had tried to login to the e-way bill system with incorrect username and password for more than 5 times. Hence, the system has blocked your account for security reasons and it will be unblocked after 5 minutes.

What should I do, if I do not remember my username and password?

If you have forgotten the username or password, then use the ‘Forgot Username’ or ‘Forgot Password’ facility provided on the portal to recollect your username or create new password accordingly. The user needs to enter some details after authenticating the same via an OTP, then, user will be provided with the username and password.

Whether Part-B is must for e-way bill?

E-Way bill is complete only when Part-B is entered. Otherwise printout of EWB would be invalid for movement of goods. Filling up of Part-B of the e-way bill is a must for movement of the goods, except for within the same state movement between consignor place to transporter place, if distance is less than 50 Kms.

Can I transport goods with the e-way bill without vehicle details in it?

No. One needs to transport the goods with an e-way bill specifying the vehicle number, which is carrying the goods. However, where the goods are transported for a distance of less than fifty kilometers within the State from the place of business of consignor to the place of the transporter for further transportation, then the vehicle number is not mandatory. Similar exception up to 50 KM has been given for movement of goods from place of business of transporter to place of business of consignee.

Whether the e-way bill is required for movement of consignment for weighment to the weighbridge?

No e-Way bill is required for movement of goods up to a distance of 20 Km from the place of business of consignor to a weighbridge for weighment or from the weighbridge back to the place of business of consignor, within the same State, subject to the condition that the movement of goods is accompanied by a delivery challan issued in accordance with Rule 55.

Who all can update the vehicle number for the e-way bill?

The Vehicle number can be updated by the generator of the e-way bill or the transporter assigned by the generator for that particular e-way bill.

Can Part-B of e-way bill entered/updated by any other transporter?

The present transporter can fill or update PART-B of the EWB. The e-way bill can be assigned from one transporter to another transporter, for further movement of consignment. Under this circumstance, the latest transporter, assigned for that e-way bill, can update Part-B of EWB.

If the vehicle, in which goods are being transported, having e-way bill is changed, then what is required to be done?

The e-way bill for transportation of goods should always have the vehicle number that is actually carrying the goods. There may be requirement to change the vehicle number after generating the e-way bill or after commencement of movement of goods, due to trans-shipment or due to breakdown of vehicle. In such cases, the transporter or generator of the e-way bill can update the new vehicle number in Part B of the EWB.

What is to be done (in an EWB) if the vehicle breaks down?

If the vehicle breaks down, when the goods are being carried with an EWB, then transporter can get the vehicle repaired and continue the journey in the same EWB. If he has to change the vehicle, then he has to enter the new vehicle details in that EWB, on the eway bill portal, using ‘Update vehicle number’ option in Part B and continue the journey in a new vehicle, within the original validity period of the e-way bill.

How many times can Part-B or Vehicle number be updated for an e-way bill?

The user can update Part-B (Vehicle details) as many times as he wants for movement of goods to the destination. However, the updating should be done within the validity period.

Can the e-way bill entry be assigned to another transporter by authorized transporter?

The authorized transporter can assign the e-way bill to any enrolled or registered transporter for further transportation of the goods. Subsequently, the new transporter can only update the Part-B of the EWB.

In case of transportation of goods via rail/air/ship mode, when is user required to enter transport document details, as it is available only after submitting of goods to the concerned authority?

Where the goods are transported by railways or by air or vessel, the Part B of the e-way bill can be updated either before or after the commencement of movement. But, where the goods are transported by railways, the railways shall not deliver the goods, unless the e-way bill as required under these rules is produced to them, at the time of delivery.

If the goods having e-way bill has to pass through trans-shipment and through different vehicles, how it has to be handled?

Some of the consignments are transported by the transporter through transshipment using different vehicles before it is delivered to the recipient at the place of destination. Hence for each movement from one place to another, the transporter needs to update the vehicle number in which he is transporting that consignment in part B of the E Way Bill.

Can I use different modes of transportation to carry the goods having an e-way bill? If so, how to update the details?

Yes. One can transport goods through different modes of transportation – Road, Rail, Air, Ship. However, PART-B of the e-way bill has to be updated with the latest mode of transportation or conveyance number using ‘Update vehicle number/mode of transport ’ option in the Portal. That is, at any point of time, the details of conveyance specified in the e-way bill on the portal, should match with the details of conveyance through which goods are actually being transported.

How to enter multiple modes of transportation, i.e., road, rail, ship, air for the same e-way bill?

One e-way bill can go through multiple modes of transportation before reaching the destination. As per the mode of transportation, the EWB can be updated with new mode of transportation by using ‘Update Vehicle Number’.

Let us assume the goods are moving from Cochin to Chandigarh through road, ship, air, and road again. First, the taxpayer generates the EWB by entering the first stage of movement (by road) from his place to ship yard and enters the vehicle number. Next, he will submit the goods to ship yard and update the mode of transportation as Ship and transport document number on the e-way bill system. Next, after reaching Mumbai, the taxpayer or concerned transporter updates movement as the road from shipyard to the airport with vehicle number. Next the taxpayer or transporter updates, using ‘update vehicle number’ option, the Airway Bill number. Again after reaching Delhi, he updates movement through road with vehicle number. This way, the e-way bill will be updated with multiple modes of transportation.

How does transporter come to know that particular e-way bill is assigned to him?

- The transporter comes to know that EWBs are assigned to him by the taxpayers for transportation, in one of the following ways:

After login at EWB portal, the transporter can go to reports section and select ‘EWB assigned to me for trans’ and see the list. He can also see these details on his dashboard, after login to EWB portal. - The transporter can go to ‘Update Vehicle No’ and select ‘Generator GSTIN’ option and enter taxpayer GSTIN of taxpayer, who has assigned the EWB to him.

How does the transporter handle multiple e-way bills which pass through transshipment from one place to another in different vehicles, to reach the destinations?

Some of the transporters move the consignments from one place to another place before the goods reach the destination, as per the movement of vehicles. Sometimes the consignments are moved to 8-10 branches of the transporter before they reach their destination. The consignments reach the particular branch of the transporter from different places in different vehicles. These consignments are sorted out, to be transported to different places in different Vehicles. Now, the concerned branch user instead of updating the vehicle for each one of the EWBs can generate ‘Consolidated EWB’ for multiple EWBs which are going in one vehicle towards next branch/destination.

How to handle the goods which move through multiple trans-shipment places?

Some of the consignments move from one place to another place till they reach their destinations. Under this circumstance, each time the consignment moves from one place to another, the transporter needs to enter the vehicle details using ‘Update Vehicle Number’ option in part B of the EWB, when he starts moving the goods from that place. The transporter can also generate ‘Consolidated EWB’ with the EWB of that consignment with other EWBs and move the consignment to next place. This has to be done till the consignment reaches the destination. But it should be within the validity period of a particular EWB.

Can the e-way bill be deleted or cancelled?

The e-way bill once generated cannot be deleted. However, it can be cancelled by the generator within 24 hours of generation. If a particular EWB has been verified by the proper officer, then it cannot be cancelled. Further, the e-way bill can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill.

Whether the e-way bill can be cancelled? If yes, under what circumstances?

Yes, e-way bill can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill. The e-way bill can be cancelled within 24 hours from the time of generation.

Who can reject the e-way bill and. Why?

The person who causes transport of goods shall generate the e-way bill specifying the details of other person as a recipient of goods. There is a provision in the common portal for the other party to see the e-way bill generated against his/her GSTIN. As the other party, one can communicate the acceptance or rejection of such consignment specified in the e-way bill. If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-way Bill or the time of delivery of goods whichever is earlier, it will be deemed that he has accepted the details.

How does the taxpayer or recipient come to know about the e-way bills generated on his GSTIN by other person/party?

As per the rule, the taxpayer or recipient can reject the e-way bill generated on his GSTIN by other parties. The following options are available for him to see the list of e-way bills:

- He can see the details on the dashboard, once he logs into the system.

- He will get one SMS every day indicating the total e-way bill activities on his GSTIN.

- He can go to reject option and select date and see the e-way bills. Here, the system shows the list of e-way bills generated on his GSTIN by others.

- He can go to report and see the ‘EWBs by other parties’.

What is a consolidated e-way bill?

Consolidated e-way bill is a document containing the multiple e-way bills for multiple consignments being carried in one conveyance (goods vehicle). That is, the transporter, carrying multiple consignments of various consignors and consignees in one vehicle can generate and carry one consolidated e-way bill instead of carrying multiple e-way bills for those consignments.

Who can generate the consolidated e-way bill?

A transporter can generate the consolidated e-way bills for movement of multiple consignments in one vehicle.

What is the validity of consolidated e-way bill?

Consolidated EWB is like a trip sheet and it contains details of different EWBs in respect of various consignments being transported in one vehicle and these EWBs will have different validity periods.

Hence, Consolidated EWB does not have any independent validity period. However, individual consignment specified in the Consolidated EWB should reach the destination as per the validity period of the individual EWB.

What has to be done, if the vehicle number has to be changed for the consolidated e-way bill?

There is an option available under the ‘Consolidated EWB’ menu as ‘regenerate CEWB’. This option allows you to change the vehicle number to existing Consolidated EWB, without changing the individual EWBs. This generates a new CEWB, which has to be carried with new vehicle. Old CEWB will become invalid for use.

Can the ‘consolidated e-way bill’ (CEWB) have the goods / e-way bills which are going to be delivered before reaching the destination defined for CEWB?

Yes, the consolidated e-way bill can have the goods or e-way bills which will be delivered to multiple locations as per the individual EWB included in the CEWB. That is if the CEWB is generated with 10 EWBs to move 3 consignments to destination Y and 7 consignments to destination X, then on the way the transporter can deliver 3 consignments to destination Y out of 10 and move with remaining 7 consignments to the destination X with the same CEWB. Alternatively, two CEWB can be generated one for 3 consignments for destination Y and another CEWB for 7 consignments for destination X.

What are the modes of e-way bill generation, the taxpayer can use?

The e-way bill can be generated by any of the following methods:

- Using Web-based system

- Using SMS based facility

- Using Android App

- Bulk generation facility

- Using Site-to-Site integration

- Using GSP (Goods and Services Tax Suvidha Provider)

How can the taxpayer use the SMS facility to generate the e-way bill?

The taxpayer has to register the mobile numbers through which he intends to generate the e-way bill on the e-way bill system. Please see the user manual for SMS based e-way bill generation available on the portal for further details.

How can the taxpayer use the Android App to generate the e-way bill?

The taxpayer has to register the IMEI (International Mobile Equipment Identity) number of the mobile phones through which he intends to generate the e-way bill on the e-way bill system. Please see the user manual for Mobile App based e-way bill generation available on the portal for further details.

How to download mobile app?

The mobile app is available only for the taxpayers and enrolled transporters. It is not available in Play Store. The main user has to login and select the ‘for mobile app’ under registration menu. The system asks to select the user/sub-user and enter the IMEI number of the user. Once it is entered, the concerned user gets the link in his registered mobile to download the app through SMS. Now, the user has to download the app by clicking that link and enable it to get installed on the mobile.

What is bulk generation facility and who can use it?

Through this facility, the user can upload multiple invoices and generate multiple e-Way bill in one go. This facility can be used by the taxpayers or transporters who have automated their invoice generation system. In one go, they can prepare bulk requests for e-way bills in a file from their automated system, and upload it on the common portal and generate e-way bill in one go. This avoids duplicate data entry into e-way bill system and avoids data entry mistakes also. Any taxpayer or transporter can use the bulk generation facility.

How to use the bulk generation facility?

To use the bulk generation facility, one has to prepare the e-way bill requests through JSON file. This can be done in two ways – registered taxpayer or transporter can prepare the JSON file directly from his automated system. If he is unable to do so, he can use excel based bulk generation tool available on the portal. The invoice and other details need to be entered as per the format and JSON file can be generated. This JSON file needs to be uploaded to the portal for generation of multiple e-Way bills. For more details, please refer to the ‘user manual of the bulk generation’ and ‘bulk generation tools’ under tool section at EWB portal and follow the instructions.

Bulk generation facility can be used for what activities on e-way bill portal?

One can use bulk generation facility for

- Generation of e-way bills

- Updation of Part-B of e-way bills

- Generation of Consolidated e-way bills

Please refer to the user manual of the bulk generation tools on the portal.

What are the benefits of the bulk generation facility?

Benefits of the bulk generation facility are as follows:

- Generation of multiple e-way bills in one go.

- It avoids duplicate keying in of the invoices to generate e-way bills.

- It avoids the data entry mistakes while keying in for generation of e-way bills.

How can the registered person integrate his/her system with e-way bill system to generate the e-way bills from his/her system?

The integration between e-way bill system and registered persons’ system can be done through APIs. For availing this facility, the registered person should register the server details of his/her systems (through which he wants to generate the e-way bill using the APIs of e-way bill system) with e-way bill system. For further details, please go through the user manual.

What is API Interface?

API interface is a site-to-site integration of two systems. Using this, the taxpayer can link his IT system with EWB system to generate EWB directly from his IT solution without keying in the details for EWB form in the Portal. This reduces duplicate data entry and eliminates the data entry mistakes.

What are the benefits of API Interface?

Presently registered person generates invoices from his IT system and logs into EWB system and enters e-way bill details and generate e-way bills. Here, the taxpayer has to make double entries – once for Invoice generation in his system and second time for e-way bill generation. He can integrate his system with EWB system through API. The EWB details are sent from taxpayer system to e-Way bill system through APIs and generation of e-way bill happens at e-Way bill system instantaneously. The eWay bill data is sent back to the taxpayer system by the e-Way bill system so that EWB data can be stored in the taxpayer’s system itself. This will lead saving of manpower and cost of the operator for this purpose. Secondly API interface will eliminate data entry mistakes/errors being made by the operator. It also saves time. Thirdly e-way bill number can be stored by the taxpayer system in his database with the corresponding invoice. Even in the invoice itself, EWB number can be printed so that printout of EWB need not be taken out and carried out along with the vehicle, separately.

What are the pre-requisites for using API interface?

API interface is a site-to-site integration of website of a taxpayer with the EWB system. API interface can be used by large taxpayers, who need to generate more than 1000 invoices / e-way bills per day. However, the taxpayer should meet the following criteria to use the API interface:

- His invoicing system should be automated with IT solutions.

- He should be ready to change his IT system to integrate with EWB system as per API guidelines.

- He should be generating at least 1000 invoices/e-way bills per day.

- His system should have SSL based domain name.

- His system should have Static IP Address.

- He should have pre-production system to test the API interface.

How does the taxpayer become transporter in the e-way bill system?

Generally, registered GSTIN holder will be recorded as supplier or recipient and he will be allowed to work as supplier or recipient. If registered GSTIN holder is the transporter, then he will be generating EWB on behalf of supplier or recipient. He needs to enter both supplier and recipient details while generating EWB, which is not allowed as a supplier or recipient.

To change his position from supplier or recipient to transporter, the taxpayer has to select the option ‘Register as Transporter’ under registration and update his profile. Once it is done with logout and re-login, the system changes taxpayer as a transporter and allows him to enter details of both supplier and recipient in EWB as per invoice.

How does the taxpayer update his latest business name, address, mobile number or e-mail id in the e-way bill system?

EWB System( ewaybillgst.gov.in ) is dependent on GST Common portal (gst.gov.in) for taxpayers registration details like legal name/trade name, business addresses, mobile number and e-mail id. EWB System will not allow taxpayer to update these details directly in the EWB portal. If taxpayer changes these details at GST Common portal, it will be updated in EWB system within a day automatically. Otherwise, the taxpayer can update the same instantaneously by selecting the option ‘Update My GSTIN’ in the e-Way bill system and the details will be fetched from the GST common portal (gst.gov.in) and updated in the e-Way bill system.

Why do I need sub-users?

Most of the times, the taxpayer or authorized person himself cannot operate and generate EWBs. He may in that case authorize his staff or operator to do that. He would not like to avoid sharing his user credentials with them. In some firms, the business activities will be operational 24/7 and some firms will have multiple branches. Under these circumstances, the main user can create sub-users and assign different roles to them. He can assign generation of EWB or rejection or report generation activities based on requirements to different sub-users.

This facility helps him to monitor the activities done by sub-users. However, the main user should ensure that whenever employee is transferred or resigned, the sub-user account is frozen / blocked to avoid mis-utilisation.

How many sub-users can be created?

For every principal/additional place of business, a user can create a maximum of 3 sub-users. That is, if taxpayer has only (one) principal business place (and no additional place of business), he can create 3 sub-users. If tax payer has 3 additional places and one principal place of business ( ie 4 places), then he can create 12 (4 X 3) sub-users.

Why are the reports available only for a particular day?

The user is allowed to generate report on daily basis. Because of criticality of the system for performance for 24/7 operation, the reports are limited to be generated for a day. The user can change date and generate the report for that date. Hence, the user is advised to generate report daily and save in his system.

Why masters have to be entered?

EWB system has an option to enter the masters of user – client master, supplier master, transporter master and product master. If the user creates these masters, it will simplify the generation of an e-way bill for him. That is, the system auto populates the details like trade/legal name, GSTIN, address on typing few characters of client or supplier, HSN Code, tax rates etc. It also avoids data entry mistakes by the operator while keying in the details.

Can I upload the masters available in my system?

Yes, you can upload your customers, suppliers and product details into e-way bill system by preparing the data as per the format provided in the tools option in the portal and upload in the master option after logging in.

What is a detention report under grievance menu?

If the goods or the vehicle of the taxpayer or transporter has been detained by the tax officers for more than 30 minutes, then the transporter can enter the detention report on EWB Portal, which will reach the designated officer immediately, so that he can take an appropriate action accordingly.

When is a detention report to be raised?

Where a vehicle has been intercepted and detained for a period exceeding thirty minutes, the transporter may upload the said information in the EWB system. The detention report will go to the concerned senior GST State/Central officer to redress the grievance.

What is Over Dimensional Cargo?

Over Dimensional Cargo mean a cargo carried as a single indivisible unit and which exceeds the dimensional limits prescribed in rule 93 of the Central Motor Vehicle Rules 1989 made under the Motor Vehicles Act, 1988.

How the consignor is supposed to give authorization to transporter or e-commerce operator and courier agency for generating PART-A of e-way bill?

It is their mutual agreement and way out to do the same. If a transporter or courier agency or the e-commerce operator fills PART-A, it will be assumed by the department that they have got authorization from consignor for filling PART-A.

In case of Public transport, how to carry e-way bill?

In case of movement of goods by public transport, e-way bill shall be generated by the person who is causing the movement of the goods, in case of any verification, he can show e-way bill number to the proper officer.

What is the meaning of consignment value?

It is the value of the goods declared in an invoice, a bill of challan or a delivery challan, as the case may be, issued in respect of the said consignment and also include Central tax, State or Union territory tax, Integrated tax, and Cess charged if any. But, it will not include the value of exempt supply of goods, where the invoice is issued in respect of both exempt and taxable supply. It will also not include the value of freight charges for the movement charged by the transporter.

In case of movement of goods by Railways, is there a requirement for railway to carry e-way bill along with goods?

In case of movement of goods by Railways, there is no requirement to carry e-way bill along with the goods, but railways has to carry invoice or delivery challan or bill of supply as the case may be along with goods. Further, e-way bill generated for the movement is required to be produced at the time of delivery of the goods. Railways shall not deliver goods unless the e-way bill required under rules is produced at the time of delivery. But for the purposes of e-way bill, the expression ‘transported by railways’ does not include the ‘leasing of parcel space by Railways’.

If the value of the goods carried in a single conveyance is more than 50,000/- though value of all or some of the individual consignments is below Rs. 50,000/-, does transporter need to generate e-way bill for all such smaller consignments?

As rule 138(7) will be notified from a future date, hence till the notification for that effect comes, transporter needs not generate e-way bill for consignments having value less than Rs 50,000/-, even if the value of the goods carried in single conveyance is more than Rs 50,000/-, till the said sub-rule is notified.

Does the vehicle carrying goods from CSD to unit run canteens need e-way bill?

No, these are exempted supply and therefore have been exempted from the requirement of carrying e-way bill.

Is the e-way bill required for the movement of empty cargo containers?

No, such movement has been exempted from e-way bill.

Does the movement of goods under Customs seal require e-way bill?

No, such movement has been exempted from e-way bill.

Does the movement of goods which are in transit to or from Nepal/Bhutan, require e-way bill for movement?

No, such movement has been exempted from e-way bill.

Is the temporary vehicle number allowed for e-way bill generation?

Yes, temporary vehicle number can also be inserted as vehicle number for the purpose of e-way bill generation.

Whether e-way bill is required for intra -State movement of goods?

At present e-way bill is required only for inter-State movement of goods. For intra-State movement of goods the requirement for e-way bill will be introduced in a phased manner, for which rules will be notified by respective states separately.

I am dealer in tractors. I purchased 20 tractors from the manufacturer. These tractors are not brought on any motorized conveyance as goods but are brought to my premise by driving them. Also, these tractors have not got the vehicle number. Is e-way bill required in such cases?

E-way bill is required in such cases. The temporary number or any identifiable number with the tractor have to be used for filling details of the vehicle number for the purpose of e-way bill generation.

Who is responsible for EWB generation in case DTA sales from SEZ/FTWZ?

There is no special provision for such supply and hence the registered person who causes movement of goods shall be responsible for the generation of e-Way bill as per the rules.

In many cases where manufacturer or wholesaler is supplying to retailers, or where a consolidated shipment is shipped out, and then distributed to multiple consignees, the recipient is unknown at the time the goods are dispatched from shipper’s premises. A very common example is when FMCG companies send a truck out to supply kirana stores in a particular area. What needs to be done in such cases?

In such cases, movement is caused on behalf of self. No supply is being made. In such cases, delivery challan may be used for generation of e-way bills. All the provisions for delivery challan need to be followed along with the rules for e-way bills.

What should be the value in e-waybill in case goods are sent on lease basis as the value of machine is much higher than leasing charges?

The value of goods needs to be mentioned as per the explanation 2 of the sub–rule (1) of rule 138.

Expired stock has no commercial value, but is often transported back to the seller for statutory and regulatory requirements, or for destruction by seller himself. What needs to be done for such cases of transportation of the expired stock?

E-way bills are required even in cases where goods are moved for reasons other than supply. Delivery Challan has to be the basis for generation of e-way bill in such cases.

Whether shipping charges charged by E-commerce companies needs to be included in ‘consignment value’ though the same is not mentioned on merchant’s invoice?

Consignment value of goods would be the value determined in accordance with the provisions of section 15. It will also include the central tax, State or Union territory tax, integrated tax, and cess charged if any. So shipping charges charged by E- by the e-commerce companies need not be included in the ‘consignment value’.

Where an invoice is in respect of both goods and services, whether the consignment value should be based on the invoice value (inclusive of value of services) or only on the value of goods. Further, whether HSN wise details of service is also required to be captured in Part A of the e-way bill in such case.

Consignment value and HSN needs to be determined for goods only not for services as only the goods are in movement and e-way bill needs to be generated accordingly.

What is Goods and Services Tax (GST)?

It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

What exactly is the concept of destination based tax on consumption?

The tax would accrue to the taxing authority which has jurisdiction over the place of consumption which is also termed as place of supply.

Which of the existing taxes are proposed to be subsumed under GST?

The GST would replace the following taxes:

1. Taxes currently levied and collected by the Center:

- Central Excise duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Central Surcharges and Cesses so far as they relate to supply of goods and services

2. State taxes that would be subsumed under the GST are:

- State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax (all forms)

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on advertisements

- Purchase Tax

- Taxes on lotteries, betting and gambling

- State Surcharges and Cesses so far as they relate to supply of goods and services

The GST Council shall make recommendations to the Union and States on the taxes, cesses and surcharges levied by the Center, the States and the local bodies which may be subsumed in the GST.

What principles were adopted for subsuming the above taxes under GST?

The various Central, State and Local levies were examined to identify their possibility of being subsumed under GST. While identifying, the following principles were kept in mind:

1. Taxes or levies to be subsumed should be primarily in the nature of indirect taxes, either on the supply of goods or on the supply of services.

2. Taxes or levies to be subsumed should be part of the transaction chain which commences with import/ manufacture/ production of goods or provision of services at one end and the consumption of goods and services at the other.

3. The subsumation should result in free flow of tax credit in intra and inter-State levels. The taxes, levies and fees that are not specifically related to supply of goods & services should not be subsumed under GST.

4. Revenue fairness for both the Union and the States individually would need to be attempted.

Which are the commodities proposed to be kept outside the purview of GST?

Article 366(12A) of the Constitution as amended by 101st Constitutional Amendment Act, 2016 defines the Goods and Services tax (GST) as a tax on supply of goods or services or both, except supply of alcoholic liquor for human consumption. So alcohol for human consumption is kept out of GST by way of definition of GST in constitution. Five petroleum products viz. petroleum crude, motor spirit (petrol), high speed diesel, natural gas and aviation turbine fuel have temporarily been kept out and GST Council shall decide the date from which they shall be included in GST. Furthermore, electricity has been kept out of GST.

What will be the status in respect of taxation of above commodities after introduction of GST?

The existing taxation system (VAT & Central Excise) will continue in respect of the above commodities.

What will be status of Tobacco and Tobacco products under the GST regime?

Tobacco and tobacco products would be subject to GST. In addition, the Center would have the power to levy Central Excise duty on these products.

What type of GST is proposed to be implemented?

It would be a dual GST with the Center and States simultaneously levying it on a common tax base. The GST to be levied by the Center on intra-State supply of goods and / or services would be called the Central GST (CGST) and that to be levied by the States/ Union territory would be called the State GST (SGST)/ UTGST. Similarly, Integrated GST (IGST) will be levied and administered by Center on every inter-state supply of goods and services.

Why is Dual GST required?

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of Government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism.

Which authority will levy and administer GST?

Center will levy and administer CGST & IGST while respective states /UTs will levy and administer SGST/ UTGST.

Why was the Constitution of India amended recently in the context of GST?

Currently, the fiscal powers between the Center and the States are clearly demarcated in the Constitution with almost no overlap between the respective domains. The Center has the powers to levy tax on the manufacture of goods (except alcoholic liquor for human consumption, opium, narcotics etc.) while the States have the powers to levy tax on the sale of goods. In the case of inter-State sales, the Center has the power to levy a tax (the Central Sales Tax) but, the tax is collected and retained entirely by the States. As for services, it is the Center alone that is empowered to levy service tax.

Introduction of the GST required amendments in the Constitution so as to simultaneously empower the Center and the States to levy and collect this tax. The Constitution of India has been amended by the Constitution (one hundred and first amendment) Act, 2016 for this purpose. Article 246A of the Constitution empowers the Center and the States to levy and collect the GST.

How a particular transaction of goods and services would be taxed simultaneously under Central GST (CGST) and State GST (SGST)?

The Central GST and the State GST would be levied simultaneously on every transaction of supply of goods and services except the exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of CENVAT. While the location of the supplier and the recipient within the country is immaterial for the purpose of CGST, SGST would be chargeable only when the supplier and the recipient are both located within the State.

Illustration I: Suppose hypothetically that the rate of CGST is 10% and that of SGST is 10%. When a wholesale dealer of steel in Uttar Pradesh supplies steel bars and rods to a construction company which is also located within the same State for, say Rs. 100, the dealer would charge CGST of Rs. 10 and SGST of Rs. 10 in addition to the basic price of the goods. He would be required to deposit the CGST component into a Central Government account while the SGST portion into the account of the concerned State Government. Of course, he need not actually pay Rs. 20 (Rs. 10 + Rs. 10) in cash as he would be entitled to set-off this liability against the CGST or SGST paid on his purchases (say, inputs). But for paying CGST he would be allowed to use only the credit of CGST paid on his purchases while for SGST he can utilize the credit of SGST alone. In other words, CGST credit cannot, in general, be used for payment of SGST. Nor can SGST credit be used for payment of CGST.

Illustration II: Suppose, again hypothetically, that the rate of CGST is 10% and that of SGST is 10%. When an advertising company located in Mumbai supplies advertising services to a company manufacturing soap also located within the State of Maharashtra for, let us say Rs. 100, the ad company would charge CGST of

Rs. 10 as well as SGST of Rs. 10 to the basic value of the service. He would be required to deposit the CGST component into a Central Government account while the SGST portion into the account of the concerned State Government. Of course, he need not again actually pay Rs. 20 (Rs. 10+Rs. 10) in cash as it would be entitled to set-off this liability against the CGST or SGST paid on his purchase (say, of inputs such as stationery, office equipment, services of an artist etc.). But for paying CGST he would be allowed to use only the credit of CGST paid on its purchase while for SGST he can utilise the credit of SGST alone. In other words, CGST credit cannot, in general, be used for payment of SGST. Nor can SGST credit be used for payment of CGST.

What are the benefits which the Country will accrue from GST?

Introduction of GST would be a very significant step in the field of indirect tax reforms in India. By amalgamating a large number of Central and State taxes into a single tax and allowing set-off of prior-stage taxes, it would mitigate the ill effects of cascading and pave the way for a common national market. For the consumers, the biggest gain would be in terms of a reduction in the overall tax burden on goods, which is currently estimated at 25%-30%. Introduction of GST would also make our products competitive in the domestic and international markets. Studies show that this would instantly spur economic growth. There may also be revenue gain for the Center and the States due to widening of the tax base, increase in trade volumes and improved tax compliance. Last but not the least, this tax, because of its transparent character, would be easier to administer.

What is IGST?

Under the GST regime, an Integrated GST (IGST) would be levied and collected by the Center on inter-State supply of goods and services. Under Article 269A of the Constitution, the GST on supplies in the course of inter- State trade or commerce shall be levied and collected by the Government of India and such tax shall be apportioned between the Union and the States in the manner as may be provided by Parliament by law on the recommendations of the Goods and Services Tax Council.

Who will decide rates for levy of GST?

The CGST and SGST would be levied at rates to be jointly decided by the Center and States. The rates would be notified on the recommendations of the GST Council.

What would be the role of GST Council?

A GST Council would be constituted comprising the Union Finance Minister (who will be the Chairman of the Council), the Minister of State (Revenue) and the State Finance/Taxation Ministers to make recommendations to the Union and the States on

- the taxes, cesses and surcharges levied by the Center, the States and the local bodies which may be subsumed under GST;

- the goods and services that may be subjected to or exempted from the GST;

- the date on which the GST shall be levied on petroleum crude, high speed diesel, motor sprit (commonly known as petrol), natural gas and aviation turbine fuel;

- model GST laws, principles of levy, apportionment of IGST and the principles that govern the place of supply;

- the threshold limit of turnover below which the goods and services may be exempted from GST;

- the rates including floor rates with bands of GST;

- any special rate or rates for a specified period to raise additional resources during any natural calamity or disaster;

- special provision with respect to the North- East States, J&K, Himachal Pradesh and Uttarakhand; and

- any other matter relating to the GST, as the Council may decide.

What is the guiding principle of GST Council?

The mechanism of GST Council would ensure harmonization on different aspects of GST between the Center and the States as well as among States. It has been provided in the Constitution (one hundred and first amendment) Act, 2016 that the GST Council, in its discharge of various functions, shall be guided by the need for a harmonized structure of GST and for the development of a harmonized national market for goods and services.

How will decisions be taken by GST Council?

The Constitution (one hundred and first amendment) Act, 2016 provides that every decision of the GST Council shall be taken at a meeting by a majority of not less than

3/4th of the weighted votes of the Members present and voting. The vote of the Central Government shall have a weight-age of 1/3rd of the votes cast and the votes of all the State Governments taken together shall have a weight-age of 2/3rd of the total votes cast in that meeting. One half of the total number of members of the GST Council shall constitute the quorum at its meetings.

Who is liable to pay GST under the proposed GST regime?

Under the GST regime, tax is payable by the taxable person on the supply of goods and/or services. Liability to pay tax arises when the taxable person crosses the turnover threshold of Rs.20 lakhs (Rs. 10 lakhs for NE & Special Category States) except in certain specified cases where the taxable person is liable to pay GST even though he has not crossed the threshold limit. The CGST / SGST is payable on all intra-State supply of goods and/or services and IGST is payable on all inter- State supply of goods and/or services. The CGST /SGST and IGST are payable at the rates specified in the Schedules to the respective Acts.

What are the benefits available to small tax payers under the GST regime?

Tax payers with an aggregate turnover in a financial year up to [Rs.20 lakhs & Rs.10 Lakhs for NE and special category states] would be exempt from tax. Further, a person whose aggregate turnover in the preceding financial year is less than Rs.50 Lakhs can opt for a simplified composition scheme where tax will payable at a concessional rate on the turnover in a state.

[Aggregate turnover shall include the aggregate value of all taxable supplies, exempt supplies and exports of goods and/or services and exclude taxes viz. GST.] Aggregate turnover shall be computed on all India basis. For NE States and special category states, the exemption threshold shall be [Rs. 10 lakhs]. All taxpayers eligible for threshold exemption will have the option of paying tax with input tax credit (ITC) benefits. Tax payers making inter-State supplies or paying tax on reverse charge basis shall not be eligible for threshold exemption.

How will the goods and services be classified under GST regime?

HSN (Harmonised System of Nomenclature) code shall be used for classifying the goods under the GST regime. Taxpayers whose turnover is above Rs. 1.5 crores but below Rs. 5 crores shall use 2-digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4-digit code. Taxpayers whose turnover is below Rs. 1.5 crores are not required to mention HSN Code in their invoices.

Services will be classified as per the Services Accounting Code (SAC)

How will imports be taxed under GST?

Imports of Goods and Services will be treated as inter-state supplies and IGST will be levied on import of goods and services into the country. The incidence of tax will follow the destination principle and the tax revenue in case of SGST will accrue to the State where the imported goods and services are consumed. Full and complete set-off will be available on the GST paid on import on goods and services.

How will Exports be treated under GST?

Exports will be treated as zero rated supplies. No tax will be payable on exports of goods or services, however credit of input tax credit will be available and same will be available as refund to the exporters. The Exporter will have an option to either pay tax on the output and claim refund of IGST or export under Bond without payment of IGST and claim refund of Input Tax Credit (ITC).

What is the scope of composition scheme under GST?

Small taxpayers with an aggregate turnover in a preceding financial year up to [Rs. 50 lakhs] shall be eligible for composition levy. Under the scheme, a taxpayer shall pay tax as a percentage of his turnover in a state during the year without the benefit of ITC. The rate of tax for CGST and SGST/UTGST shall not be less than [1% for manufacturer & 0.5% in other cases; 2.5% for specific services as mentioned in para 6(b) of Schedule II viz Serving of food or any other article for human consumption]. A tax payer opting for composition levy shall not collect any tax from his customers. The government may increase the above said limit of 50 lakhs rupees to up to one crore rupees, on the recommendation of GST Council.

Tax payers making inter- state supplies or making supplies through eCommerce operators who are required to collect tax at source shall not be eligible for composition scheme.

Whether the composition scheme will be optional or compulsory?

Optional.

What is GSTN and its role in the GST regime?

GSTN stands for Goods and Service Tax Network (GSTN). A Special Purpose Vehicle called the GSTN has been set up to cater to the needs of GST. The GSTN shall provide a shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders for implementation of GST.

The functions of the GSTN would, inter alia, include:

- facilitating registration;

- forwarding the returns to Central and State authorities;

- computation and settlement of IGST;

- matching of tax payment details with banking network;

- providing various MIS reports to the Central and the State Governments based on the tax payer return information;

- providing analysis of tax payers’ profile; and

- running the matching engine for matching, reversal and reclaim of input tax credit.

The GSTN is developing a common GST portal and applications for registration, payment, return and MIS/ reports. The GSTN would also be integrating the common GST portal with the existing tax administration IT systems and would be building interfaces for tax payers. Further, the GSTN is developing back-end modules like assessment, audit, refund, appeal etc. for 19 States and UTs (Model II States). The CBEC and Model I States (15 States) are themselves developing their GST back-end systems. Integration of GST front-end system with back-end systems will have to be completed and tested well in advance for making the transition smooth.

How are the disputes going to be resolved under the GST regime?

The Constitution (one hundred and first amendment) Act, 2016 provides that the Goods and Services Tax Council shall establish a mechanism to adjudicate any dispute-

(a) between the Government of India and one or more States; or

(b) between the Government of India and any State or States on one side and one or more other Sates on the other side; or

(c) between two or more States,

arising out of the recommendations of the Council or implementation thereof.

What is the purpose of Compliance rating mechanism?

As per Section 149 of the CGST/SGST Act, every registered person shall be assigned a compliance rating based on the record of compliance in respect of specified parameters. Such ratings shall also be placed in the public domain. A prospective client will be able to see the compliance ratings of suppliers and take a decision as to whether to deal with a particular supplier or not. This will create healthy competition amongst taxable persons.

Whether actionable claims liable to GST?

As per section 2(52) of the CGST/SGST Act actionable claims are to be considered as goods. Schedule III read with Section 7 of the CGST/SGST Act lists the activities or transactions which shall be treated neither as supply of goods nor supply of services. The Schedule lists actionable claims other than lottery, betting and gambling as one of such transactions. Thus only lottery, betting and gambling shall be treated as supplies under the GST regime. All the other actionable claims shall not be supplies.

Whether transaction in securities be taxable in GST?

Securities have been specifically excluded from the definition of goods as well as services. Thus, the transaction in securities shall not be liable to GST.

What is the concept of Information Return?

Information return is based on the idea of verifying the compliance levels of registered persons through information procured from independent third party sources. As per section 150 of the CGST/SGST Act, many authorities who are responsible for maintaining records of registration or statement of accounts or any periodic return or document containing details of payment of tax and other details of transaction of goods or services or both or transactions related to a bank account or consumption of electricity or transaction of purchase, sale or exchange of goods or property or right or interest in a property under any law for the time being in force, are mandated to furnish an information return of the same in respect of such periods, within such time, in such form and manner and to such authority or agency as may be prescribed. Failure to do so may result in penalty being imposed as per Section 123.

Different companies have different types of accounting software packages and no specific format are mandated for keeping records. How will department be able to read into these complex software?

As per Section 153 of the CGST/SGST Act, having regard to the nature and complexity of a case and in the interest of revenue, department may take assistance from an expert at any state of scrutiny, inquiry, investigation or any other proceedings.

Is there any provision in GST for tax treatment of goods returned by the recipient?