The model GST Law released by the Ministry of Finance contains provisions relating to tax deducted at source. Though TDS provisions already exist in most of the state VAT Acts for payments in case of works contract, there is no such concept of TDS under service tax.

Latest update

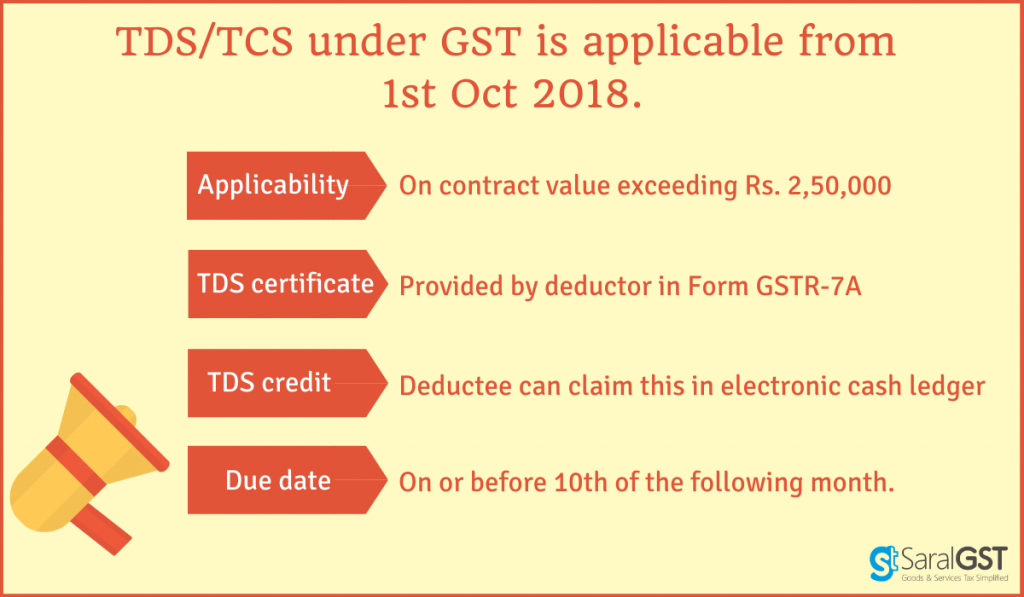

TDS/TCS under GST is being implemented from 1st Oct 2018. Eligible Deductor should deduct TDS is the contract value exceeds Rs. 250,000.

Deductor has to provide deductee with TDS certificate in Form GSTR-7A which will be made available online, with 5 days of TDS credit to government. Deductee can claim this TDS credit, in their electronic cash ledger. The due date for filing GSTR-7 is on 10th of the following month.

TDS provisions under GST are summarised below for a better understanding. We will be discussing these topics which are listed below:

- Applicability of TDS provisions

- The rate of TDS

- Deposit of TDS to the government

- Failure to deposit TDS

- The issue of the certificate of deduction

- Failure to issue the certificate

- Return for TDS

- The credit of tax deducted in electronic cash ledger of deductee

- Refund

- TCS on online sales of goods and service

Applicability of TDS provisions

As per the draft GST law, the Central Government / State Government may mandate certain category of persons to deduct tax from the payments made to the suppliers of taxable goods/service where the total value of supply, under a contract, exceeds rupees ten lakh.

The various departments which may come under TDS are:

- Department or establishment of the Central or State Government, or

- Local authority

- Governmental agencies

- Such persons or category of persons as may be notified

The rate of TDS

The purchaser (referred as ‘Deductor’) is required to deduct tax @ 2% from the payments made to the supplier (referred as ‘Deductee’).

For deducting TDS, the value of supply shall be taken as the amount excluding the tax indicated on the invoice.

Deposit of TDS to the Government

The tax deducted by the deductor shall be paid to the appropriate Government within 10 days from the end of the month in which the deduction is made.

Failure to deposit TDS

In case the deductor fails to pay the tax deducted to the Government, he shall be liable to pay interest in addition to the amount deducted.

The issue of Certificate of deduction

On deducting the tax, the deductor has to furnish a certificate of deduction to the deductee within five days of crediting the amount deducted to the appropriate Government.

The certificate shall contain the contract value, the rate of deduction, the amount deducted, the amount paid to the Government and any other details which may be prescribed.

Failure to Issue certificate

Failure to Issue certificate

Failure to furnish the certificate within the timeframe will attract the late fee of Rs 100 per day after the expiry of five days till the failure is rectified, subject to a maximum amount of Rs 5000/-.

Return for Tax deducted at source

Deductor has to file a monthly return of tax deducted by 10th of the succeeding month in GSTR-7.

The credit of tax deducted in electronic cash ledger of deductee

On the basis of the information reflecting in the TDS return of the deductor, the deductee can claim the credit of the tax deducted.

Refund

In case of excess deduction or erroneous deduction, refund to the deductor or deductee will be dealt in accordance with the refund provisions of the draft law.

However, there will be no refund to the deductor in case the amount deducted has already been credited to the electronic cash ledger of the deductee.

TCS on online sales of goods and service

The model GST Law proposes the introduction of Tax Collected at Source mechanism.

Under TCS provisions, all e-commerce establishments are required to collect tax at the time of credit/payment to the supplier.

The amount collected should be deposited to the appropriate Government, within 10 days of the end of the month in which the collection is made.

Conclusion

The levy of TDS / TCS provisions though increases the compliance burden its boosts the tax collections and also ensures that even the unorganized business sectors come under the ambit of GST as the TDS will be deducted by the organized sectors.